First published: Nov. 12, 2023 | Permalink | RSS

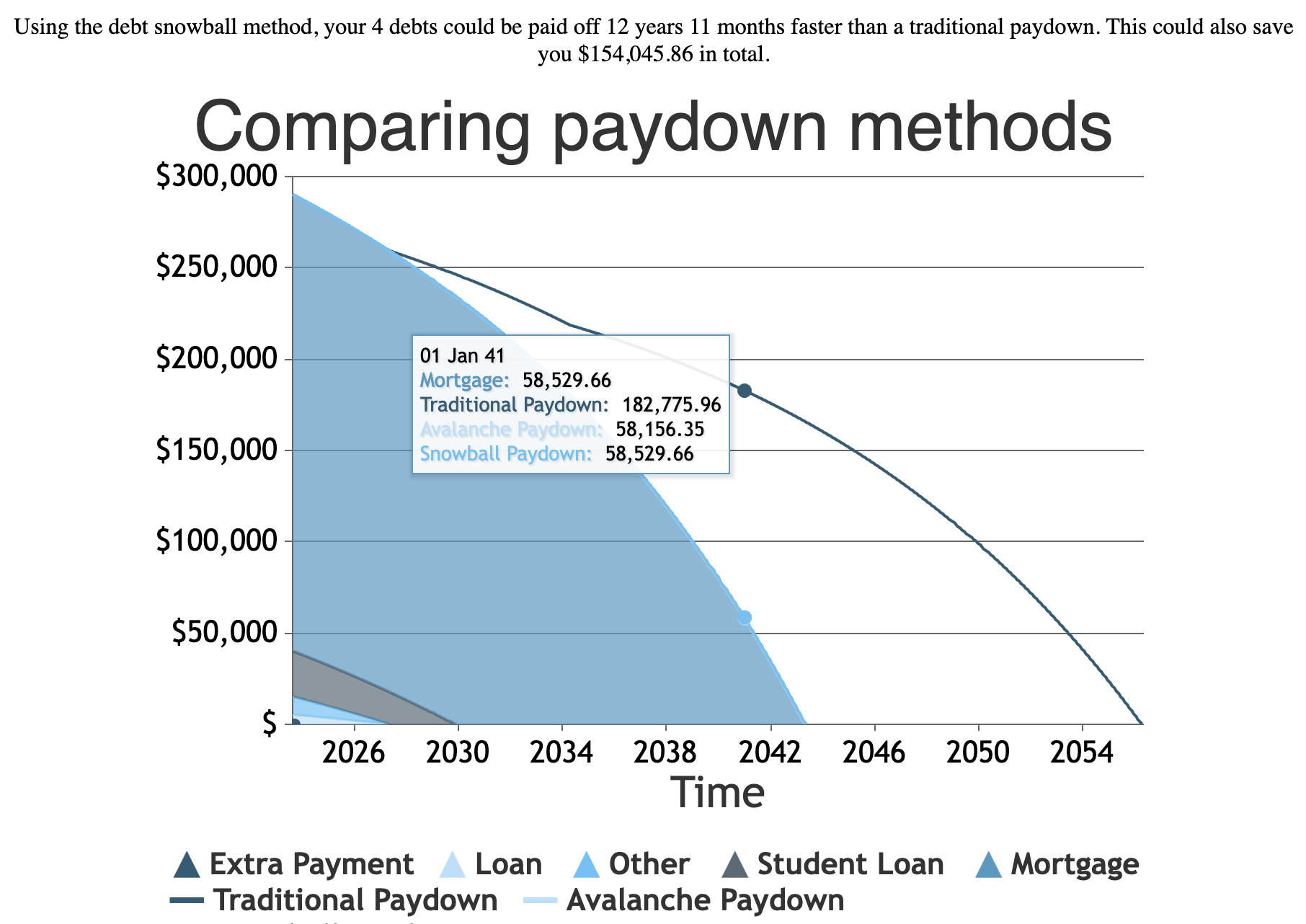

A screenshot of the debt snowball chart showing the paydown of the debts compared to the traditional payment plan

Earlier this year I built a project that came from a personal need. I have three student loans from my time at University of the Arts, my time at Temple University, and my coding bootcamp. My spouse Ruby has her own loans from undergraduate and graduate school. We also share a mortgage on our home. I have been exploring different options to ideally pay down these debts early and save both money on interest and time for ourselves in the future with less debt payment burden.

As part of my research, the most personally compelling plan I found is called the debt snowball plan. The essence of the plan is:

- Order your debts from smallest to largest by remaining principle on each loan.

- Pay only the minimums on each loan.

- Optionally if you are able and want to pay extra to accelerate the process, only apply the extra amount to the smallest loan’s monthly payments.

- Once the smallest is paid off, take what you were paying each month and add that to the monthly payment of the next smallest plan.

- Repeat the last step until all of your debts are paid off.

What is nice about this plan is that, unless you are adding extra each month to accelerate the plan, the amount you pay towards your debts each month stays the same. Arguably this is also a drawback, since the monthly payment burden stays the same, even as debts are resolved. I am not a financial expert but appreciate the simplicity and effectiveness of this plan. There are similar approaches like the debt avalanche, which works similarly except that the first step is to order the debts from highest interest rate to lowest. My understanding is that while also effective, the avalanche is slower overall, but especially slower to start feeling the benefits of paying off the first debt in the sequence.

For our situation, without going too deeply into our personal finances, following this plan would allow us to pay off our student loans a few years early. However, the much bigger effect is that our mortgage would be paid off about 14 years earlier than the 30 years our mortgage is planned for. If all goes to plan, this would save us a lot in interest and dramatically cut down our living expenses. Granted, all our loan terms allow us to pay down the principal ahead of schedule, and not all loans allow this (although they absolutely should). You should check your terms on your loans before making any plans.

Now that I understood this plan, I wanted to show Ruby how this may benefit us, but needed a way to show her how it works. There are many debt snowball calculators, and most have great written descriptions, but almost none of the ones I came across had any sort of chart showing how the plan is paid off over time. I am always one to make a plan with a spreadsheet (including vacation plans) and my favorite part of any spreadsheet is creating charts.

Having charts would also help me explain the concept and benefits to Ruby, but also would help me visualize for myself the differences between different plans and also continuing to pay the minimums. Faced with a serious dearth of charts amongst the existing resources, I did what all engineers do when faced with a missing tool: I began to build it myself.

To build this out I had to do some research on how loans, interest, and amortization work at a more detailed level than I had really thought about since learning about complex and simple interest in high school math classes. I started with a spreadsheet for myself, but quickly realized that what I wanted was a webpage. I found it much easier to create loops and recursive functions with JavaScript than with spreadsheet macros. Besides, if I was looking for debt snowball charts, others likely were too, so once I had a complete site, I could share it publicly as well. You should try it out and see if a plan like this might work for you.

I built this early on in my learnings about permacomputing and building out smaller websites with just HTML, CSS, and JavaScript. I wanted to lean on and design around the HTML tags as they exist. I think I did an okay job with this but some of the parts of how this is built go against some of my better design sensibilities.

In particular, I think the site uses too much text without intentional visual hierarchy and too little color to help orient a person to what to use or read first. I do still think this project works but I learned some things about designing a project from scratch and would like to revisit the aesthetics of this project sometime. Overall, I am still happy with how it came out for a weekend project. Plus, I do still use this to occasionally to recheck my own financial plans as our life and the world around us changes.

Excitingly, we have our snowball rolling down the hill and are just this week starting to see it picking up some momentum. My loans from my time at UArts were fully paid off at the beginning of this month and I was able to use what I was paying towards that and put it towards my boot camp loan payments. It feels wonderful so far and I look forward to completing this plan.

Thank you for reading!